ARTICLE 1: GENERAL PRINCIPLES

- Scope

These Financial Regulations come into force on 1 January 2023.

They form part of the terms and conditions of participation in the Championship.

Each F1 Team participating in the Championship agrees to be bound by and undertakes to comply with these Financial Regulations. - Objectives

- These Financial Regulations introduce a system of fair and equal spending in the World Series and in the Continental ones, and create opportunities to fund training and development for drivers, teams and circuits where needed.

- These Financial Regulations are designed to achieve the following objectives:

- To promote the competitive balance of the Championship;

- To promote the sporting fairness of the Championship;

- To ensure the long-term financial stability and sustainability of the F1 Teams;

- To give access to Formula One to young drivers, engineers, entrepreneurs, managers, etc. from environments where they’re currently blocked.

- The FIA has a specific panel (“The Panel”) that will review financial statements and reporting documents to assess them and validate them; it also has the power to deliver fines or penalties to teams that breach the Financial Regulations

- The Financial Regulation are accepted in full by all teams and people participating to the Formula One World Title and those participating to the Continental Series.

- Financial Regulations may be amended and/or supplemented by the parliament of attendees in each Series, also depending on world economy conditions.

- Accountability

- Each F1 Team must ensure that all Personnel are made aware:

- Of the Objectives, content and substance of these Financial Regulations; and

- That the F1 Team is subject to these Financial Regulations.

- Each F1 Team must ensure that all relevant Personnel are appropriately informed and trained with respect to the ways in which their areas of responsibility may impact the F1 Team’s compliance with these Financial Regulations.

- Each F1 Team must ensure that the FIA ethics and compliance policy in force from time to time with respect to these Financial Regulations is clearly communicated to all Personnel.

- Each F1 Team must ensure that all Personnel are made aware:

ARTICLE 2: F1 TEAM OBLIGATIONS

- Each F1 Team must:

- Demonstrate its ongoing compliance by submitting Reporting Documentation respecting deadlines and requirements of the FIA Panel;

- Cooperate fully and in a timely manner with the Panel in the exercise of its regulatory function, including any investigation;

- Provide any information and documentation requested by or on behalf of the Panel relevant to any actual, potential or suspected instance of noncompliance with these Financial Regulations; and

- Faithfully execute its obligations under these Financial Regulations and act at all times in a spirit of Good Faith and cooperation.

- Financial Fairness

- Each team must present:

- At the beginning of the season a projected Balance Document for the incoming season, which has to target at least a balance budget (including assumptions of income from sporting results).

- At the end of the season the Reporting Balance Document for the season that just ended, which has to demonstrate that the balance budget has been achieved.

- No restriction on the currency as long as all items in the Balance are in the same currency and both documents are presented using the same currency as well.

- All costs resulting from activities undertaken by the team to design, manufacture, purchase and use the car(s) across the official Formula 1 events and private testing, and of any F1 Activities incurred by entities within the F1 Team’s Legal Group Structure have to be included in the Balance.

Exceptions will be provided in the following articles. - All revenues coming from sponsorships, commercial agreements, TV rights, performance bonuses (i.e. winning, podiums), marketing events or any other source received by the F1 Team’s Legal Group Structure should be included in the Balance.

- Exclusions are:

- Costs for Marketing activities (i.e. transferring people and equipment to perform a one-off show for marketing purposes only).

- All costs of Consideration provided to F1 Drivers, or to a Connected Party of that F1 Driver, in exchange for that F1 Driver providing the services of an F1 Driver to or for the benefit of the F1 Team, together with all travel and accommodation costs in respect of each F1 Driver.

That includes official and reserve/testing drivers. - All costs directly attributable to Heritage Asset Activities.

- All Corporate Income Tax.

- Costs for building new facilities (i.e. new wind tunnel/offices).

- All costs Directly Attributable to Non-F1 Activities.

- All Property Costs.

- All Employee Bonus Costs, subject to a maximum amount in any Full Year Reporting Period of the lower of 20% of the Total Fixed Employee Remuneration.

- All Financial Penalties in respect of any breach of these Financial Regulations.

- All amounts of depreciation, amortisation, impairment loss, and amounts as a result of revaluation or disposal of tangible assets and intangible assets.

- All foreign exchange gains and losses recognised in profit or loss, whether arising from settlement and/or re-measurement of monetary items denominated in a foreign currency, or otherwise.

- All costs related to employment contracts in case of maternity, paternity, sick leaves as they’re covered in different ways by different countries.

- All Employee Termination Benefits.

- Adjustments

- Offsetting of income and costs:

- If a Reporting Group Entity has offset any income or gains within its Total Costs, or any costs or losses within its revenue, the F1 Team must make an upward adjustment in the calculation of Relevant Costs to gross up these amounts, unless such offsetting is permitted under its applicable accounting standards or it falls under the following:

- finance income may be offset against Finance Costs, provided that any exclusion made pursuant to the articles above is made net of finance income; or

- tax credits in respect of Corporate Income Tax may be offset against tax charges in respect of Corporate Income Tax, provided that any exclusion made pursuant to articles above is made net of tax credits in respect of Corporate Income Tax.

- If a Reporting Group Entity has recognised income from a government incentive scheme within its revenue in respect of certain research and development costs included within its Total Costs, the F1 Team must make a downward adjustment in the calculation of Relevant Costs to offset such income against those research and development costs.

- If a Reporting Group Entity has offset any income or gains within its Total Costs, or any costs or losses within its revenue, the F1 Team must make an upward adjustment in the calculation of Relevant Costs to gross up these amounts, unless such offsetting is permitted under its applicable accounting standards or it falls under the following:

- Offsetting of income and costs:

- Each team must present:

ARTICLE 3: REPORTING REQUIREMENTS

- Full Year Reporting Documentation

By the Full Year Reporting Deadline, an F1 Team must submit the Reporting Balance Document to the Panel assessed by an Independent Audit Firm.

ARTICLE 4: COST CAP ADMINISTRATION

- The Panel is responsible for administering these Financial Regulations, including exercising the powers and carrying out the functions set out in this Article 4.

- The Panel will monitor compliance with these Financial Regulations,investigate instances of suspected non-compliance, and take appropriate enforcement action in respect of any breaches of these Financial Regulations.

- The Panel will have appropriate procedures in place to maintain the confidentiality of any Confidential Information provided to it by an F1 Team.

- The Panel may issue guidance notes from time to time to assist the F1 Teams in complying with these Financial Regulations.

Such guidance notes shall be advisory only and shall not constitute Financial Regulations. - Clarification of the Financial Regulations

- The CFO of an F1 Team may submit a written request to the Panel in order to clarify the operation or interpretation of these Financial Regulations. The Panel will respond in writing to any such request and will make available to the CFOs of all other F1 Teams a summary of the written request along with the response, omitting any Confidential Information. Such clarifications shall be advisory only and shall not constitute Financial Regulations.

- The CFO of an F1 Team may submit a written request to the Panel in order to clarify the operation or interpretation of these Financial Regulations. The Panel will respond in writing to any such request and will make available to the CFOs of all other F1 Teams a summary of the written request along with the response, omitting any Confidential Information. Such clarifications shall be advisory only and shall not constitute Financial Regulations.

- Review of Reporting Documentation

- The Panel will review the Reporting Documentation submitted by an F1 Team to assess whether that F1 Team has complied with these Financial Regulations.

- The Panel may engage an Independent Audit Firm to assist in reviewing an F1 Team’s Reporting Documentation and to undertake a comparative financial analysis of the Reporting Documentation in order to help identify potential anomalies.

- Each F1 Team shall provide such additional information, documentation or clarification in relation to its compliance with these Financial Regulations as the Panel may require from time to time.

- Once the Reporting Documentation has been reviewed, the Panel shall conclude either:

- That an F1 Team has complied with these Financial Regulations, in which case the Panel shall issue a compliance certificate to the applicable F1 Team; or

- That an F1 Team has not complied with these Financial Regulations, in which case the Panel shall decide a fine or penalty for the non-compliant team as per articles below.

- There shall be no right of appeal against any decision by the Panel to issue a compliance certificate to an F1 Team.

- Regulatory function

The Panel may during a Reporting Period require an F1 Team to provide information and/or documentation for the sole purpose of enabling the Panel to perform its regulatory function as contemplated by these Financial Regulations. - Investigations

- The Panel may conduct investigations into an F1 Team’s compliance with these Financial Regulations, assisted, if it chooses, by an Independent Audit Firm.

- Upon completion of an investigation, any decision by the Panel as to whether or not to take further action in accordance with these Financial Regulations will be at the sole discretion of the Panel taking into consideration the substance of the information disclosed and the merits of each case.

- The Panel may require support of people inside the F1 team to conduct the investigation.

Each team must make these people available and they have to support the investigation in accordance with the laws and the sport values. - In relation to any investigation, an F1 Team must, and must procure that the other members of the F1 Team’s Legal Group Structure shall:

- Cooperate fully with any such investigation and must procure that all Personnel cooperate fully with the investigation, as may be required;

- Grant access to the information and records of that F1 Team and/or of any member of the F1 Team’s Legal Group Structure to any of the Panel, the Independent Audit Firm appointed by the Panel;

- Make electronic devices of that F1 Team and/or of any member of the F1 Team’s Legal Group Structure available for inspection and download to any of the Panel, the Independent Audit Firm appointed by the Panel; and

- Facilitate access to such of its premises, individuals, information, and documentation as may be required.

- Each F1 Team must retain and preserve its accounting books and records in a manner that shall enable the Panel, the Independent Audit Firm appointed, to understand to its satisfaction, the content of the Full Year Financial Reporting Documentation submitted by that F1 Team in respect of the previous five Full Year Reporting Periods.

- Complaints procedure

- If an F1 Team believes that another F1 Team has not complied with these Financial Regulations, it may submit a report to the Panel.

- Upon receipt of a written report from a Complainant Team, the Panel shall conduct an investigation into the reported non-compliance, subject to the following mandatory conditions being met:

- The report identifies the non-complying F1 Team and clearly summarises the relevant non-compliance in each case. If a Complainant Team wishes to report non-compliance in respect of more than one F1 Team, the Complainant Team must submit a separate report in respect of each F1 Team to the Panel;

- The report clearly specifies the relevant provision(s) of these Financial Regulations which have not been complied with;

- The report is made in Good Faith and the signatories to the relevant report have reasonable grounds to believe that the information reported is true, accurate and duly supported by evidence;

- The report includes sufficient valid evidence in support of each reported instance of non-compliance;

- The report shall be signed by the CEO and CFO of the Complainant Team.

- The Panel may, in its sole discretion, decline to conduct an investigation if one or more of the mandatory conditions listed above have not been met.

- 1 Year Breach Settlement

- If a team presents an end of year Balance Document which is showing a deficit, the F1 team can request a 1 Year Breach Settlement, provided that:

- The F1 team hasn’t presented a non-compliant Balance Document in the previous two years running;

- The F1 team agrees to not overspend in the following two financial years.

- An F1 team is therefore allowed to have a deficit in Balance for a maximum of 1 time in 3 consecutive years.

- This rule is determined in order to support investments of teams that needs to recover performance and to support development of new technologies.

- The Panel will accept the settlement and will apply a Luxury Tax to the F1 team requiring it of $10,000 for every million dollars of deficit.

- The F1 team has to pay the Luxury Tax over the course of the following season.

- If the F1 team fails to pay the Luxury Tax or fails in the following 2 years to submit a balanced Reporting Document, it will be subject to penalties as described in the articles to follow.

- If a F1 team already requested a 1 Year Breach Settlement in the previous two years, the new request will be rejected to the panel and the F1 will be subject to penalties as described in the articles to follow.

- If a team presents an end of year Balance Document which is showing a deficit, the F1 team can request a 1 Year Breach Settlement, provided that:

- Audit and Penalties

- When a F1 team requires a 1 Year Breach Settlement or is audited for an alleged breach to the Financial Rules, the relevant F1 Team must:

- Acknowledge that it has breached these Financial Regulations;

- Accept, observe and satisfy the sanction(s) and/or enhanced monitoring procedures levied;

- Agree to bear the Luxury tax.

- When a F1 team requires a 1 Year Breach Settlement or is audited for an alleged breach to the Financial Rules, the relevant F1 Team must:

ARTICLE 5: JUDITIAL PANEL

- The Judicial Panel is made of 7 independent judges who will hear and determine cases of alleged breach of these Financial Regulations.

- The Judicial Panel will analyze the following circumstances:

- A F1 Team has committed a Procedural Breach;

- The F1 Team has presented a Full Year Financial Reporting Documents that does not achieve the balance, and the 1 Year Breach Settlement can’t be accepted.

- A F1 Team hasn’t paid the luxury tax.

- Complaints raised by other participants.

- A F1 team has presented a false Financial Reporting (which is also a criminal violation).

- Decision are made after 1 hearing with all parties involved, witnesses and third parties observers; only legal representatives of the parties being questioned can present evidence.

The decision is made my standard majority (4 judges to vote in the same way); judges can’t abstain.

The decision must be communicated in written to all parties and to the FIA, with clear and detailed motivations, including sanctions. - One Judge is formally nominated “President of the Panel”.

Judges mandate last for 3 year.

Every 3 years an election is run.

Judges can’t make more than 3 mandates.

If a Judge resigns or leaves his position for any other circumstances an election for the single place is made, which doesn’t affect the other Judges. - Candidates to judging roles must have adequate experience and degrees in law, finance and financial law and must have no conflict of interest with any of the participant to the World Title or the Continental Series they’re judging for.

- Appeals can be made only if the judgment was on “procedural breach”, not in the other circumstances.

ARTICLE 6: CATEGORIES OF BREACH

- Procedural Breach

- A “Procedural Breach” arises when an F1 Team breaches a procedural aspect of these Financial Regulations, except other violations that are included in the article above.

- Examples of Procedural Breaches include:

- Making a Late Submission;

- Failing to cooperate with or respond to a written request for information, documentation or clarification from the Panel within the timeframe imposed by the Panel;

- Delaying, impeding or frustrating the exercise by the Panel of its regulatory function, including an investigation conducted under the Financial Regulations, or any attempt to do so;

- Submitting Reporting Documentation that is inaccurate, incomplete or misleading.

- In the event the Panel determines that an F1 Team has committed a Procedural Breach, the Panel shall impose a Financial Penalty, unless:

- The Panel determines that sufficient mitigating factors exist to justify taking no further action; or

- The Panel determines that a sufficient aggravating factor(s) exist, in which case it shall impose a Minor Sporting Penalty (i.e. point deductions in the Constructors Championship) in addition to the Financial Penalty, or in lieu of the Financial Penalty.

- Financial (or any other) penalties will be decided case by case depending on the severity of the breach.

- Failure to pay Luxury Tax

- Failing to pay the luxury tax during the following season of a 1 Year Breach agreement will also be subject to review of the Panel.

- In this event, the Panel shall impose a further Financial Penalty, unless:

- The Panel determines that sufficient mitigating factors exist to justify taking no further action; or

- The Panel determines that a sufficient aggravating factor(s) exist, in which case it shall impose a Minor Sporting Penalty (i.e. point deductions in the Constructors Championship) in addition to the Financial Penalty, or in lieu of the Financial Penalty.

- Financial (or any other) penalties will be decided case by case depending on the circumstances of why the luxury tax hasn’t been paid in time.

- Non-Balanced Full Year Financial Reporting Documents or non-acceptable 1 Year Breach Settlement

- These cases arise when an F1 team presents, at the end of the season, a Financial Reporting Document, which is correct in the form, but does not achieve the balance for the second time in the timespan of 3 years and the F1 team has already successfully requested a 1 Year Breach Settlement in the same 3 years timeframe.

- In this event, the Panel shall impose the following penalties, depending on the amount of the breach and the reason(s) for it:

- Exclusion from the premium bonuses obtained during the season, through the final classification in the constructor championship;

- Exclusion from one or more races of the following season;

- Exclusion from the following season;

- The Panel can also decide to not take any actions against the F1 team under investigation if the deficit has been caused by an unexpected decrease of the income during the F1 season due to force majeure (i.e. economic/financial crisis or unsettlement in the country where the team operates, natural events severely damaging assets of the F1 team and forcing rebuilding/repurchasing, etc.).

In this case the year in object is not considered as a violation.

- False Accounting

- These cases arise when an F1 presents a reporting intentionally falsifying, altering or submitting false, inaccurate or deceptive records for accounting purposes.

- In this event, the F1 team is:

- Excluded from the season just concluded, losing any sporting result and premium resulting from it.

- Excluded from the following season.

- Reported to the authorities of the country where its licence and headquarters are for criminal judgment.

- Aggravating or mitigating factors

- In determining the sanctions appropriate for a particular case, the Panel shall take into account any aggravating or mitigating factors.

- Examples of aggravating factors include:

- Any element of bad faith, dishonesty, willful concealment or fraud;

- Multiple breaches of these Financial Regulations in the Reporting Period in question;

- Breaches of these Financial Regulations in respect of a previous Reporting Period;

- Failure to co-operate with the Panel and/or Independent Audit Firm appointed by the Panel.

- Examples of mitigating factors include:

- Unforeseen Force Majeure Events; and

- Full and unfettered co-operation with the Panel and/or the Independent Audit Firm appointed by the Panel.

- Payment of a Financial Penalty

- Payment of all fines under these Financial Regulations shall be made within 90 days of the date of the relevant decision, unless otherwise stated in these Financial Regulations or in the verdict of the Judicial Panel.

In the event an appeal is made, payment shall be suspended until the outcome of the appeal is determined. - Any delay in the payment of all fines under these Financial Regulations automatically divests the F1 Team concerned of the right to participate in the Championship until that payment has been made.

- Payment of all fines under these Financial Regulations shall be made within 90 days of the date of the relevant decision, unless otherwise stated in these Financial Regulations or in the verdict of the Judicial Panel.

ARTICLE 7: ARRANGEMENTS FOR NEW ENTRANTS

- An F1 Team that has been granted an FIA Super Licence for participation in the Championship must comply with these Financial Regulations from its second season, meaning that the first Full Year Reporting Documents doesn’t have to be submitted to the Panel for review, and the season will not count in the 3 years rolling timeframe for settlements.

- The new F1 will have to submit the Full Year Reporting Document to the country authority and, if it’s found guilty of false accounting, it will be subject to the same penalties as described in articles above:

- Excluded from the just-ended season, losing any sporting result and premium resulting from it.

- Excluded from the following season.

ARTICLE 8: FORMULA 1 ORGANIZATION AND FINANCIAL COMMITMENTS

The Formula One Organization is committed to ensure that new participants are joining the Championship, or replacing leaving competitors, from all continents, and that the focus of the sport is on racing and technological development.

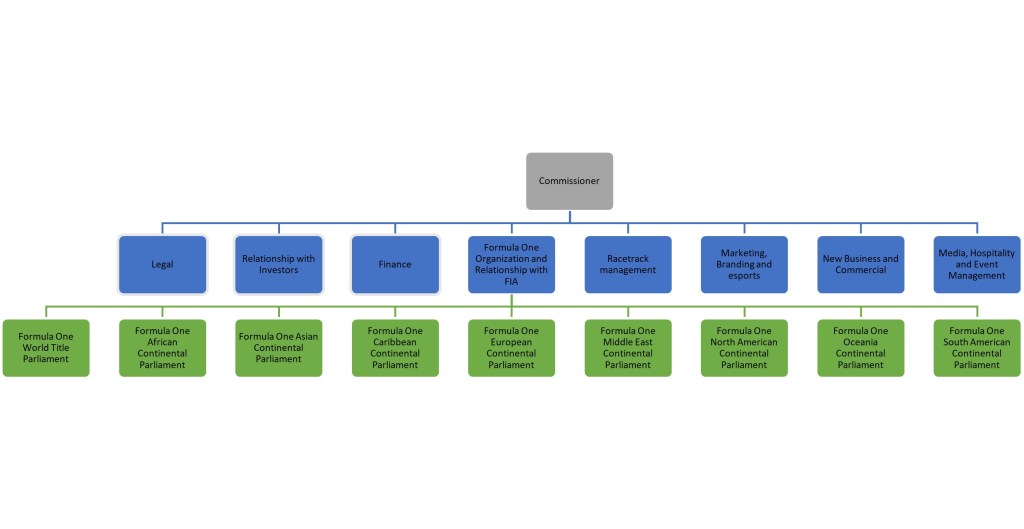

The management structure has been already reduced to limit the management cost and the organizational chart is reported in the image below.

Continental Parliaments are made of representatives of participants at each Series; the Formula One Organization is itself another parliament of nominated people from each Continental one.

Thanks to these changes the cost of management has been already dramatically reduced by eliminating external consultants for any racing matter.

The commissioner is elected by the Formula One Organization and functions as Executive Director of it, coordinating the decisions of the Formula One Organization with the decisions needed for the sport (i.e. commercial).

So the Formula One Organization, for the Formula One World Championship Series, will, each year, collect revenues coming from:

– TV rights;

– Sponsors;

– Commercial Agreements;

– Entry Fees of participants, plus any fines during the season;

– 40% of each circuit revenues (if circuits do obtain revenues from organizing a Formula One Event).

It is important to notice that circuits will not be charged any race-sanctioning fees, but they’ll have only to share with the organization 40% of the income that the Grand Prix organization has produced.

With these revenues will cover the Management Cost (i.e. salaries) plus all bonds to investors and social ones (i.e. Taxes).

The remaining part will be split as follows:

– 90% will be assigned to participating teams as decreasing prize based on the final place in the Constructor Championship.

Individual prize values will depend by the total amount of the income available and the number of teams that obtained a position in the final classification in the Constructor Championship.

– 10% will be cascaded to the Continental Formula One Series; normally it will be divided equally, unless one or more of them will required a higher percentage due to unforeseen circumstances.

Each Continental Series will then have revenues coming from:

– TV rights;

– Sponsors;

– Investors;

– Commercial Agreements;

– Entry Fees of participants, plus any fines during the season;

– 40% of each circuit revenues (if circuits do obtain revenues from organizing a Formula One Event).

It is important to notice that circuits will not be charged any race-sanctioning fees, but they’ll have only to share with the organization 40% of the income that the Grand Prix organization has produced.

– 1.25% (unless agreed otherwise in the single season) of the total income of the Formula One World Series.

The remaining part will be split as follows:

– 75% will be assigned to participating teams as decreasing prize based on the final place in the Constructor Championship.

Individual prize values will depend by the total amount of the income available and the number of teams that obtained a position in the final classification in the Constructor Championship.

– 25% will be used to create, maintain and manage engineering, motorsport engineering and motorsport management schools and academies, driving and karting schools, academies and courses, and support circuits and facilities in each Continent if needed.

ARTICLE 9: FORMULA 1 ORGANIZATION ENVIRONMENTAL COMMITMENTS

- All Formula 1 events (World and Continental ones) to be carbon neutral and achieve Zero Waste to Landfill by 2028.

- New circuits to be built to support achieving the targets above (LEED Buildings).

- All transportation between circuits in the same Continent will be done via road or via train, aiming at achieving fully electric transportation in each Continent by 2035, supporting countries in creating the necessary infrastructure.

Exceptions will be made where road or train transportation is not possible (i.e. circuits sitting on islands). - For all other transportation the target is low/zero carbon logistics & travel by 2030.

- Switch All F1 owned or operated offices or facilities to renewable power by 2030.

- New buildings will follow LEED building principles and techniques.

- Incentivize all F1 teams owned and operated offices, factories or facilities to move to renewable power and to new ones to follow LEED building principles.

- Reduce business travels not related to racing, replacing them by conference calls and virtual meetings.